JP SALAS LAW REPRESENTS POLICYHOLDERS

WITH INSURANCE CLAIM DISPUTES

JP Salas Law is the insurance claim lawyer you can trust in Broward County, FL

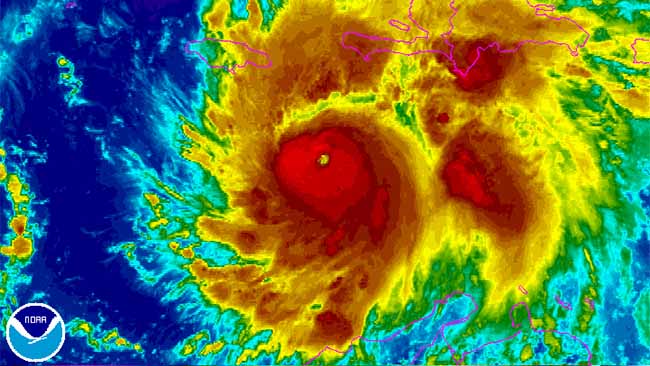

Hurricane and Windstorm Damage Claims

Fire Damage Claims

Water Damage Claims

Commercial and Business Property Claims

Condominium Insurance Claims

Insurance Bad Faith Claims

Surety Bond Claims

Construction Defects

Read More About Insurance Claims

JP Salas Law Represents Policyholders with Insurance Claim Disputes

When events, such as storms, tornadoes, fires, floods or plumbing leaks damage your home or business you instinctively file a claim with their insurance carrier. Naturally, after suffering a devastating loss to your home or business, you desperately need funds in order to get your property restored or your business running again. You have been faithfully paying premiums with the expectation that your insurance claim will be handled fairly and honestly. Unfortunately, insurance companies (backed by a team of attorneys and adjusters) routinely deny valid claims or pay the minimum amount on claims in effort to maximize their profit. Insurance Claim Lawyer, JP Salas has the experience, know-how and skill to effectively FIGHT BACK. And, we don’t just settle insurance claims, we make sure we maximize your recovery.

If you have filed a claim with your insurance company and you feel that your insurance claim has been unlawfully or unfairly denied, delayed or underpaid you should immediately seek qualified legal representation.

Contact JP Salas Law to schedule a FREE Consultation

How Much Will it Cost?

In most cases, as your insurance claim lawyer, we will agree to work with you on a contingency fee basis. This means that if there is no recovery on your claim, you pay absolutely no fees for our services or costs advanced by the firm.

Under certain circumstances if we recover money damages from the insurance company in court, your insurance company may be responsible for paying your attorney’s fees and costs.

Why JP Salas Law as your insurance claim lawyer?

- Your insurance claim dispute will be handled by a law firm that devotes 100% of its resources to representing you, the policyholders.

- Your insurance claim dispute will be handled by a results driven advocate and savvy negotiator.

- Your insurance claim dispute will be handled by a lawyer who knows how to combat an insurance company’s “deny, delay and underpay” tactics.

- Your insurance claim dispute will be handled by a lawyer who understands how insurance companies think because he used to represent them.

Five Things You Should Know About Insurance Companies

- Insurance companies make a profit on your premium payments.

- Insurance companies have an unlimited amount of time and money to fight you on your legitimate claim.

- The more they fight the more of your money they get to keep.

- Insurance companies rather delay, underpay or deny your legitimate insurance claim than to pay you what you deserve.

- Insurance companies prefer to maximize their profits over helping you, maximize your recovery.

WHAT DO I DO IF HURRICANE MATTHEW DAMAGES MY PROPERTY?

As Hurricane Matthew threatens Florida’s east coast, your priority is ensuring that you and your loved ones have enough first aid supplies, batteries, flashlights, non-perishable food and water. Likewise, you should strongly consider seeking […]

Can an insurance company investigate your social media profiles?

Social Media and Insurance Claims

Can an insurance company can deny your claim based on what you post to your social media accounts?The answer: Yes. Insurance Companies can and will investigate social media profiles. Insurance companies […]

The Insurance Company’s Obligation to Act Fairly and Quickly

Insurance companies have an obligation to act fairly and quickly to resolve policyholders’ insurance claims. This is commonly referred to as the duty of good faith and fair dealing. You need the funds to […]